Protecting Your Assets

Piece By Piece

Las Vegas Estate Planning Attorney, Author, and Scholar

Enriching Your Life and Legacy

Our approach to estate planning is one hundred percent client-centered and mission-driven. At the Law Offices of David A. Straus, we strive to lead the field in ethical and principled planning. We do not mainly focus on death planning, but planning for life. Our Las Vegas estate planning lawyer makes complex issues and processes simple and straightforward to help you make informed decisions that will shape your life and the lives of your beneficiaries.

Devoted to Estate Planning and Asset Protection in Nevada

We will help you understand the full-spectrum of estate, tax, and asset protection planning services that we offer. We are committed to education, as knowledge and understanding allow us to achieve excellence. Our attorney teaches continuing education courses in estate planning law and techniques to accounting, insurance, financial, and real estate professionals.

Our Practice Areas

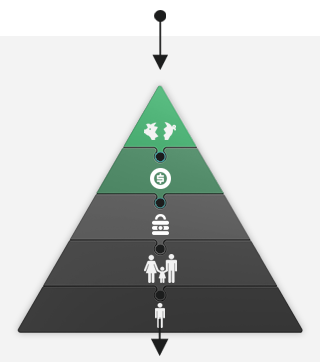

I approach every client’s unique estate plan based on Mazlow’s hierarchy of needs and motivations (progressing through physiological, safety, belongingness and love, esteem, self-actualization, and self-transcendence).

Avoid Probate & Death Tax

Funding your living trust along with

other techniques such as forming

limited partnerships, s-corporations,

foundations, and generation-skipping trusts.

Protect Wealth

Asset protection planning from

creditors, lawsuits, and

predators.

Expand Wealth

Tax planning with charitable giving and more, depending on your unique circumstances.

Family

Draft inheritances, special

needs trusts, spousal

protection, beneficiary trusts,

and discretionary trusts.

You

Avoid guardianship,

conservatorship, and living

probate trial with a good trust.

I Draft Every Trust Myself, Like a Piece of Artwork

I hold an LL.M. (Master of Laws) in Taxation, and I am a Certified Public Accountant (CPA), certified in Illinois only. Most recently I hold an LL.M. in Entertainment and Media Law. I have been drafting wills and trusts in Nevada for over thirty years.

With my legal guidance and counsel, your estate plan will employ the latest techniques available. I will help to inform your beneficiaries and other advisors of our techniques, vision, and strategy.

Faithful Enhancement and Preservation of Your Wealth

My colleagues and I are dedicated to educating our clients on the steps necessary to accomplish their estate planning goals and objectives. We are committed to providing the service, professionalism, and expertise necessary for you to fully realize maximum wealth enhancement and preservation.

Controlling Where Your Estate Will Go

Basically, your estate will go to two of three places when you die: your loved ones, charity, or the IRS — pick two. Every U.S. citizen will be a philanthropist. Either you will give voluntarily to a charity or foundation of your choice, or your wealth will go to the IRS and the government decides how your wealth is spent. I help guide you so you can control and direct exactly where every dollar in your estate will go.

Call the Law Offices of David A. Straus to Schedule a Complimentary Initial Consultation

Speak with a knowledgeable, cost-effective Las Vegas estate planning attorney about your unique needs and objectives. We serve individuals and families throughout Nevada ranging from middle-income earners to wealthy individuals and families.

No matter what your net worth is, you will benefit from an experienced lawyer who has seen and drafted everything you could ever think of in a comprehensive estate plan.

Email or call us today at 702-474-4500.